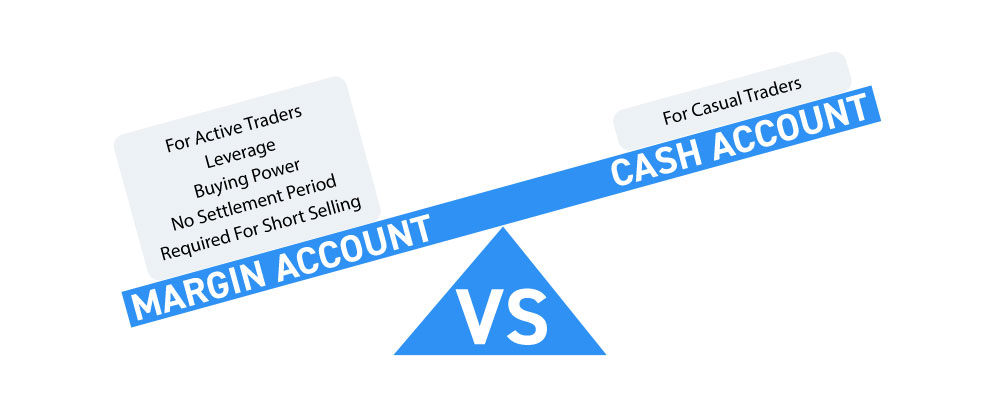

You’ve likely heard of the term margin when it comes to stock trading. Day trading accounts are usually margin accounts. They are much different from cash accounts, which may be suitable for investors and swing traders.

Most brokers provide margin and cash accounts for their customers. However, brokers vary in regard to the minimum requirements to have one or the other. Keep in mind that every brokerage account has to be either a margin or a cash account. Let’s review the key benefits and disadvantages of having a margin account versus a cash account with your brokerage.

What is a Cash Account?

A cash account with your broker enables you to buy and sell stocks and options using just the cash in your account. It’s like buying groceries with just the cash in your wallet and not a penny more. If you can’t afford it, you can’t buy it. The brokerage takes no risk since they are not lending you any money for your trades.

When you open an account at a brokerage, you will have to choose whether it will be a cash account or a margin account.

Cash Account Requirements

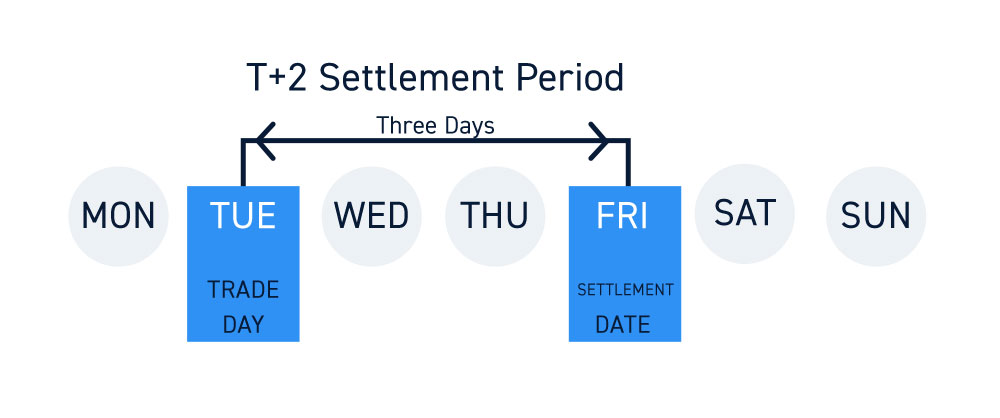

Traditional discount brokers have a minimum to open a cash account ranging from $25 to $2,000. The minimum is subjective to your brokerage. Traders can’t withdraw funds or use them until they settle following the T+2 settlement schedule (trade date plus 2 days).

Cash Account Settlement Period

In cash accounts, you can’t immediately spend the cash you receive on a stock sale. Cash accounts are subject to the T+2 settlement period. This means that if you sell a stock, it can take up to three business days for the proceeds to hit your account, which can then be used to make another stock purchase.

For example, If you have $10,000 in your cash brokerage account and buy 1000 shares at $10 and then sell the 10,000 shares at $10.25 the next day. It will take up to three business days before you can use the $10,250 in proceeds to make another trade.

Leverage

Cash accounts have no leverage. This means that no money is borrowed to bolster buying power in order to buy more shares beyond the cash that’s in the account. Keep in mind that you can only lose the cash in your account, not any more.

Who Cash Accounts Are Ideal For

Cash accounts are for very casual traders that make very few trades. They are almost entirely for investors that do not make too many round trip trades in succession. Usually, cash accounts are for smaller versions with swing or longer-term holdings. Cash accounts are only for long players since they don’t allow for short selling.

What is a Margin Account?

A margin account with your broker enables you to buy and sell stocks and options with additional leverage as the broker loans you money for your trades beyond the cash in your account. A margin account enables traders to trade with more buying power than the actual cash in the account.

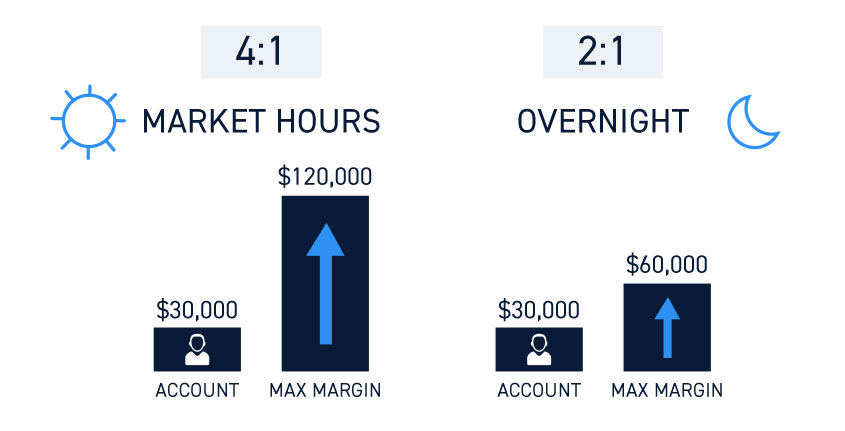

Margin leverage is usually 4-to-1 intraday if buying and closing positions in a single day and 2-to-1 if holding positions overnight or more.

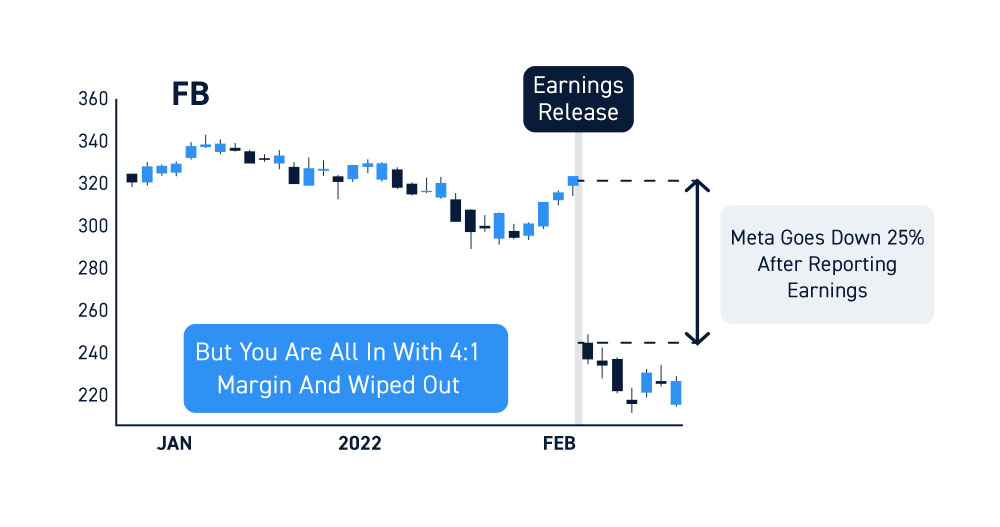

While this can magnify your profits by enabling more shares size, it can also magnify losses quicker if the trade goes against you. For example, if you have $30,000 in your account, you can buy up to $120,000 or 4:1 margin worth of stock to hold during market hours. This means you must have 25% of the equity value ($30,000) of the shares in your account. If you decide to take the position overnight, you can only take $60,000 worth of stock on the 2:1 margin. That means you must have 50% of the equity value ($30,000) of shares in your account. It’s important not to use all your margin in one stock as this is likely deemed to be a concentrated position by the broker and subject to liquidation due to the heightened risk.

Margin Account Requirements

The requirements for margin accounts can vary by broker in regarding minimum balances which can range from $2,000 to $50,000+. The higher minimums take the pattern day trading (PDT) rule into account, which is classified by executing more than three round trips in any rolling five business day period.

Who Margin Accounts Are Ideal For

Margin accounts are a requirement for active traders, especially day traders. Margin accounts enable traders to stay active and continue to make multiple trades, as long as they have a minimum of $25,000 equity in their account to in accordance with PDT rules.

Benefits of a Margin Account

There are many benefits to having a margin account even if you don’t use the margin. Having the margin available is like having a tool and not needing it, rather than needing a tool and not having it.

Required for Short Selling

If you plan to benefit from stock price drops, then you will need to get acclimated to making short sales. This requires borrowing shares from stock holders, which is handled by your broker and clearing firm. This requires a margin account. You do not have to use more than your account equity on any trade but due to the trading function margin is needed.

Required for Some Advanced Options Strategies

While you can get by with a cash account for the simply single leg strategy of going long calls or puts, you will need margin to sell to open calls or puts. Multi-leg options strategies that involve the selling of options should have margin since you need to have the capital in the account to cover the potential for being exercised.

Leverage

Leverage is the expanded buying power that margin enables you to have. The 4:1 intra day leverage and 2:1 overnight leverage can magnify your profits. However, leverage can also magnify your losses with smaller moves. Therefore, it’s important to be aware of how much leverage you’re using and possibly to adhere to stop-loss orders.

No Settlement Period

With margin accounts proceeds are immediately available to use when you close a position, this no settlement period benefit is required for active traders. Day traders getting in and out of positions rapidly throughout the day cannot have any delays in making their trades. This is the main reason active traders need to have margin.

Risks of a Margin Account

Margin accounts provide many worthwhile benefits, but they also come with new risks that you won’t face in a cash account.

Trading With “Borrowed” Money Means Risk is Multiplied

Margin means you are trading with more money than you have. This can improve the reward dramatically on your trades because you are taking larger share size, but it can also damage your account if the trade backfires. Since there is no settlement period, it can also foster overtrading, which can churn and whittle your account down.

Margin call

When your leveraged position goes against you, you can get a margin call. Margin calls can get triggered both intraday and overnight. You need to maintain the minimum maintenance margin on your trades. This means you must have at least 25% equity intra day and 50% equity overnight on your positions. When equity falls under those minimums then a margin call may trigger notifying you to deposit more funds or trim down your position to bring it back in line.

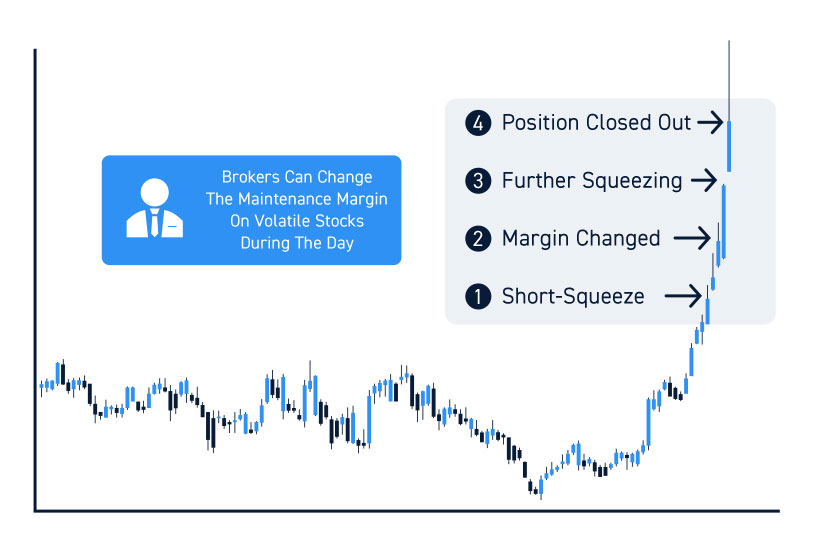

Forced liquidation

This is one of the worst outcomes with margin. If you ignore the intra day margin call alerts for too long or your losses multiply too quickly then your broker may execute a forced liquidation by closing part of your position to re-align your margin equity. Often times, this occurs in stocks that are short-squeezing which causes further squeezing from the covering of short positions by buying the underlying stock. It’s also very important that you check the maintenance margin on your stocks. Not all stocks are given 4:1 or 25% maintenance margin. Brokers can change the maintenance margin on volatile stocks during the day. This means you could have your position closed out on a forced liquidation due to the margin change during the day. This is why it’s prudent never to use all your margin and leave some extra room to avoid margin calls.

Requires Prudence and Strong Risk Management

With great (buying) power, comes great responsibility. Avoid the temptation to add into losing positions, revenge trade and over trade. It’s important to keep on top of the maintenance margin and equity requirements on volatile stocks, especially stocks prone to short-squeezing. Most importantly, it’s prudent to have the discipline to take stops before losses get too large and trigger a margin call.

You Can Lose More Than the Value of The Account

Since you are trading with borrowed funds, a fractional move against you can really hurt. It’s possible to lose more than the value of your account in situations where the stock collapses or squeezes on a gap too quickly leaving you with negative equity in your account. In these cases, you have to send in additional funds to your broker to cover your debt.