Trading halts can be a big deal for active investors, particularly if you are holding a stock that temporarily can’t be traded. But since trading halts are relatively rare, many traders don’t know why they happen or how they work.

In this guide, we’ll explain why stocks get halted and offer tips for what to do in the event of a trading halt.

What is a Stock Halt?

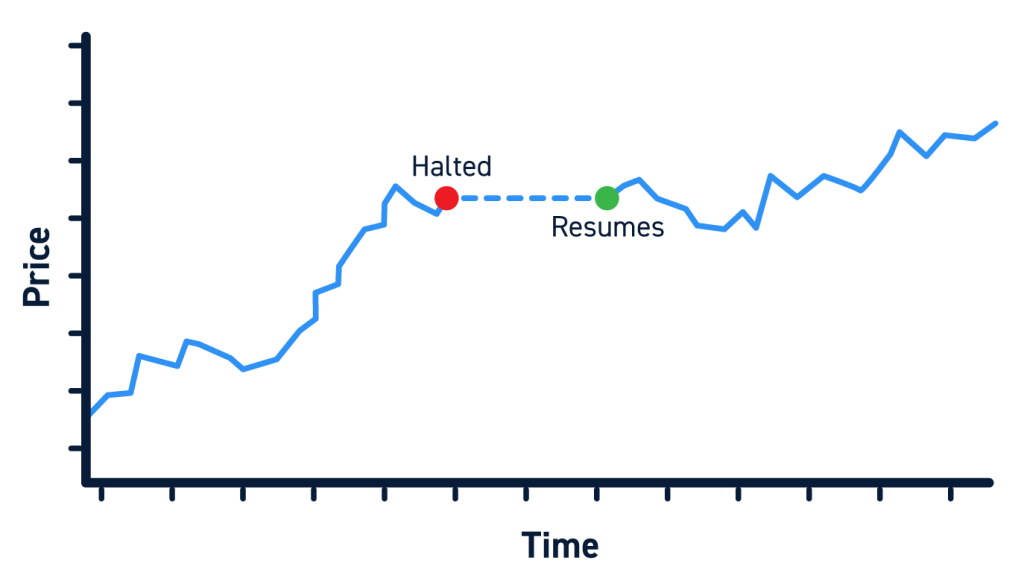

A stock halt is a temporary cessation of trading for one or more stocks. Halts can affect only one exchange on which a security trades, or it can affect all the different exchanges that trade that security.

Stock halts are typically short-lived – most are only a few minutes to a few hours long. However, some securities can experience longer halts that last for many days, especially if the halt is due to a failure to comply with exchange regulations.

During a stock halt, open orders can be cancelled and options can be exercised. However, no new trades will be executed until the stock resumes trading.

Types of Stock Halts

There are several different types of stock halts that can occur, each with different implications for trading.

Market-wide Halts

Market-wide halts are extremely rare. During a market-wide halt, most or all activity on the NASDAQ and NYSE is temporarily suspended.

These halts are usually triggered by regulatory circuit-breakers designed to prevent market crashes. For example, if the S&P 500 drops 7% from the previous day, trading is automatically halted for 15 minutes.

The last time a market-wide halt occurred was in March 2020, when the spread of the COVID-19 pandemic caused a steep drop in the US stock market.

News Halt

A news halt typically affects trading around only one company’s stock. These halts occur when a company is expected to release significant news in the middle of the trading day instead of after hours. Often, this type of news involves mergers or acquisitions, CEO resignations, regulatory approvals, or significant earnings guidance announcements.

News halts are typically requested by the company itself ahead of releasing news. They are designed to give traders and investors time to evaluate the news before making trading decisions. News halts are usually honored by all exchanges that trade a particular stock.

Compliance Halts

Compliance halts are trading halts that occur when a stock falls outside of the rules required by an exchange. For example, a compliance halt may occur when a stock falls below the market cap required to list on an exchange or fails to file information required by an exchange. Compliance halts may only affect a stock’s trading on a single exchange rather than halt trading across all exchanges.

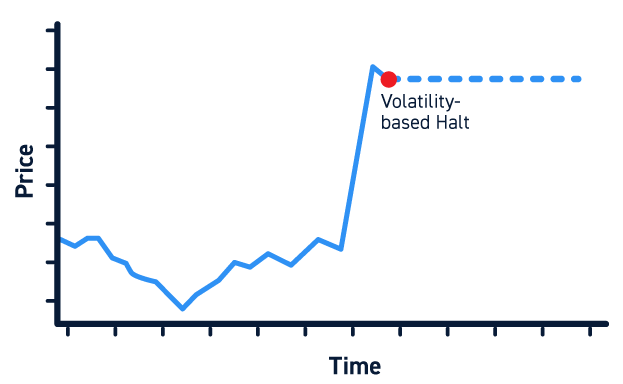

Volatility Halts

Volatility halts are circuit-breaker halts that affect only a single stock. For each stock, exchanges set upper and lower price limits based on a stock’s average price over the past 5 minutes.

If an order to buy a stock comes in below the lower limit or if an order to sell a stock comes in above the upper limit, then a 15-second warning period is initiated. If the orders are not executed or canceled within that 15-second period, then a 5-minute trading halt occurs. These halts give exchanges a chance to re-establish a new trading range for the stock.

Why Do Stocks Get Halted?

Stock halts are designed to protect traders, exchanges, companies, and ultimately trust in the market itself.

Market-wide halts introduce pauses during periods of extreme selling activity, effectively pumping the brakes to prevent uncontrolled panic selling. While these halts don’t stop selling activity – investors can simply continue selling as soon as a halt is lifted – they do give investors a chance to evaluate the situation and determine whether selling is warranted.

News halts similarly pump the brakes, albeit on a smaller scale. News halts are designed to give investors a chance to digest news before making important trading decisions based on headlines alone. That leads to more rational market activity, which protects both investors and companies.

Volatility and compliance halts help ensure that markets remain orderly and liquid. When short-term volatility increases beyond the range supported by an exchange, that can lead to problems fulfilling orders coming into the exchange. Temporarily pausing trading enables exchanges to reset the market for a stock and continue smoothly matching buy and sell orders within a new trading range.

Why Stock Halts Matter?

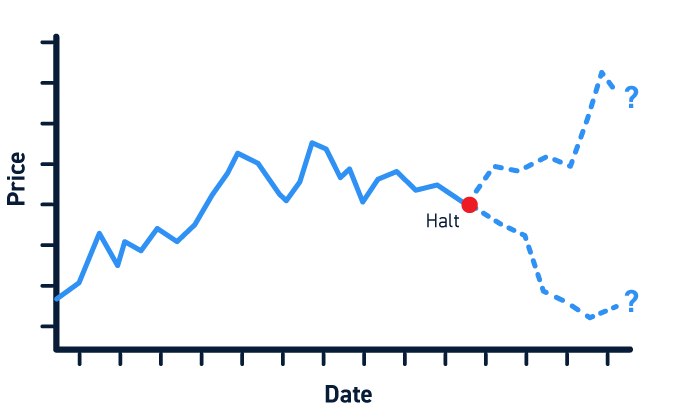

While stock halts are designed to prevent the market for a stock from spiraling out of control, they can also breed uncertainty. While the market for a stock is halted, there is no buying and selling activity to indicate where the price of that security should be.

For traders stuck holding a halted stock, it’s difficult to know whether a trend will continue, accelerate, or rapidly reverse. The lack of information can itself encourage selling activity simply because traders are incentivized to exit a highly uncertain position.

Another important consideration affects clients holding short positions when halts occur. Some fees and or interest are charged while stocks remain halted. If a stock remains halted for many days this can be a costly endeavor.

Tips for Dealing with Halts

Once you get stuck holding a halted stock, there is very little you can do except wait for the halt to end. However, there are ways to preemptively identify stocks that might be halted and to avoid holding them during a trading halt.

When trading highly volatile stocks, it’s important to pay close attention to just how volatile those stocks are. If the stock price is repeatedly moving more than 2-3% above its 5-minute moving average, trading could be paused for a volatility halt.

Compliance and news halts are more difficult to predict. However, you may be able to identify potential news halts ahead of time if you know a company is waiting on regulatory approval (for example, a pharmaceutical company waiting on a decision from the FDA) or a significant legal ruling. If you suspect a stock may be susceptible to a longer trading halt, you may want to avoid holding it overnight.

Conclusion

Stock halts can be highly disruptive for traders who get caught in the middle of them. However, they play an important role in ensuring that the stock market runs orderly and that investors have access to accurate information before making important trading decisions. The best way for traders to deal with halts is to try to avoid them entirely by keeping an eye out for high volatility and significant news that could halt trading in a stock.