Traders often take advantage of margin to increase the potential return of their trades. When trading with margin, you borrow money from your broker to increase the size of your trade. This loan comes with an interest fee, which is known as the margin rate.

In this guide, we’ll explain everything you need to know about how margin rates work.

What is Margin?

Margin is a loan you get from your brokerage firm when making a trade. Traders frequently use margin when trading because it enables them to open a larger trade or multiple large trades without having additional cash in their account. Larger trades have more potential profit, but also more potential risk.

Margin provides what is known as leverage. If you have $5,000 in your trading account and borrow $5,000 in margin from your broker for a trade, you would be applying 2:1 leverage to that trade. If you have $2,500 and borrow $10,000, you would be applying 4:1 leverage.

You can use margin for either intraday trades or overnight trades – there’s no limit at most brokers on how long you can keep a margin trade open for. However, it is important to keep in mind that the cash and securities in your trading account serve as collateral (maintenance requirement) for your leveraged position. If the value of your securities falls, you may have to add cash to your account or sell securities.

Many brokers will issue a margin call to notify you of this situation. If you do not meet a margin call by the due date, your broker can liquidate some or all of your positions in order to close out your margin.

What is a Margin Rate?

Since margin is effectively a loan from your broker, it comes with an interest rate. This rate is known as the margin rate. You can typically find the margin rates for your brokerage on your brokerage’s website or in fee disclosure documents.

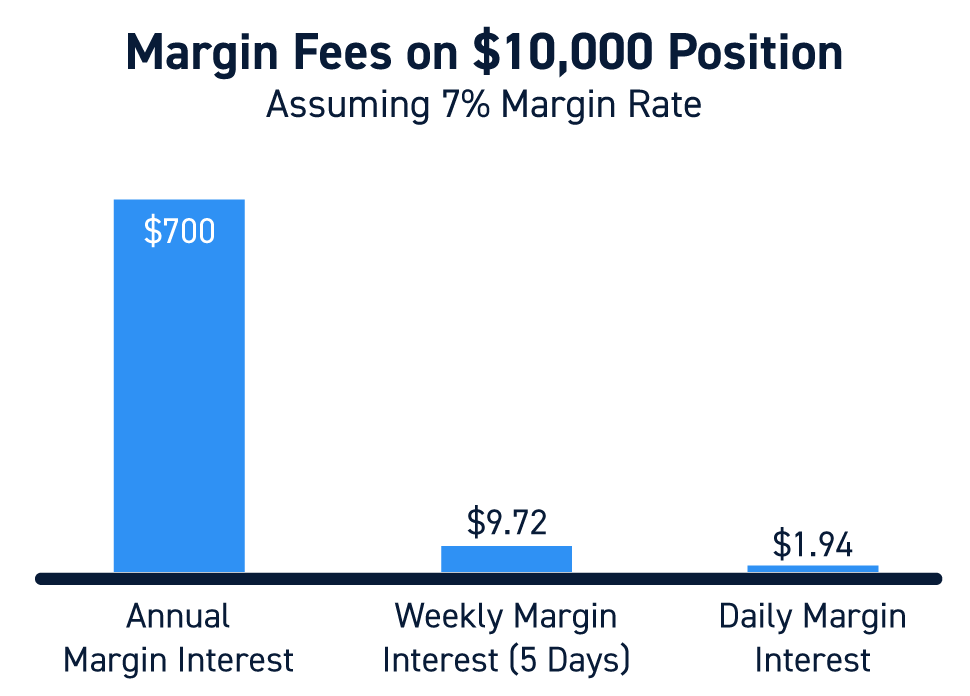

Margin rates are typically presented as annual rates. To determine how much margin will cost you in interest fees, you need to know the margin rate, how much you plan to borrow, and how long you plan to keep your position open for.

To give an example, say you want to borrow $10,000 for a position that you will keep open for 5 days and the margin rate is 7% annually. Multiply the amount you want to borrow by the margin rate, then divide by 360 (brokers typically count 360 days per year instead of 365 days). Finally, multiply by the number of days you plan to keep your position open for:

$10,000 x 0.07 = $700

$700 ÷ 360 days = $1.94/day

$1.94/day x 5 days = $9.72

In this example, borrowing $10,000 of margin for 5 days would cost $9.72.

How is a Margin Rate Determined?

Margin rates are determined by individual brokers. However, rates tend to be similar across brokers since they’re all competing to attract traders.

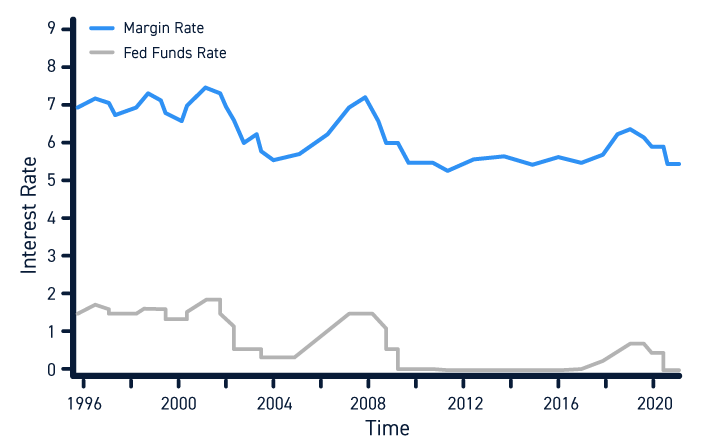

Margin rates can fluctuate depending on US monetary policy, and particularly the federal funds rate – the rate at which banks can lend to each other. As interest rates rise or fall, margin rates also tend to rise or fall.

Margin Rate FAQs

How do margin rates affect you?

Margin rates can affect the cost of trading on margin. Higher margin rates means that it’s more expensive to keep a margin trade open. So, you must expect to get a higher return from your trade in order to balance out the known cost of using margin.

Changes in margin rates affect long-term traders more than they affect day traders. Additional fees from a higher margin rate may not add up to much if your trade is only open for a day, but they can be significant if you have a trade that’s open for 30 days. In most cases brokers do not charge margin interest when clients strictly day trade and carry no margin/leverage overnight.

Also keep in that even when trading in a margin account, no margin is charged unless you are utilizing the actual leverage provided.

When is the margin rate charged?

Margin rates are charged at different times at different brokerages. Typically, margin fees for short-term trades are charged immediately after the trade is closed. For long-term trades that last more than 30 days, margin rates are charged on the 16th or the last day of the month.

How is the margin rate calculated?

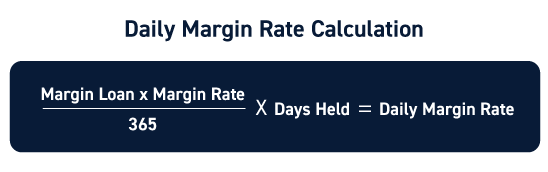

Brokers typically present margin rates as an annual percentage rate (APR). To calculate how much you’ll pay for a specific margin trade, you must know the margin rate, the amount of margin you’re using, and the duration of your trade.

Start by multiplying the amount of margin you’re using by the margin rate, then divide by 360 to calculate a daily interest fee. Finally, multiply by the number of days you plan to keep your trade open.

To give an example, say you’re borrowing $5,000 at a 6% interest rate for 20 days. In that case, the annual fee would be $300 ($5,000 x 0.06) and the daily fee would be $0.83 ($300 ÷ 360 days). The total margin fee you pay would be $16.66 ($0.83 x 20 days).

Do margin rates vary across brokers?

Margin rates do vary across brokers, but not by much. Brokers are competing for customers, so it’s in their interest to offer competitive margin rates.

Conclusion

Margin rates determine how much it costs to borrow money from your broker for trading. You can calculate how much a margin trade will cost you knowing just the margin rate, the total amount you want to borrow, and the number of days you plan to keep your trade open. Margin rates don’t vary much across brokers, but they can go up or down in response to changes in interest rates.