Quadruple witching is a market day when single stock options, stock index options, single stock futures, and stock index futures all expire. Quadruple witching days typically see above-average trading volume, although this volume isn’t necessarily accompanied by above-average volatility.

In this guide, we’ll explain what quadruple witching is, when it happens, and why traders should pay attention to it.

What is Quadruple Witching?

Quadruple witching occurs when four types of derivatives expire on the same day: stock options, stock index options, stock futures, and stock index futures. On this day, profitable options contracts are automatically executed and futures contracts are transacted or rolled over to a new contract.

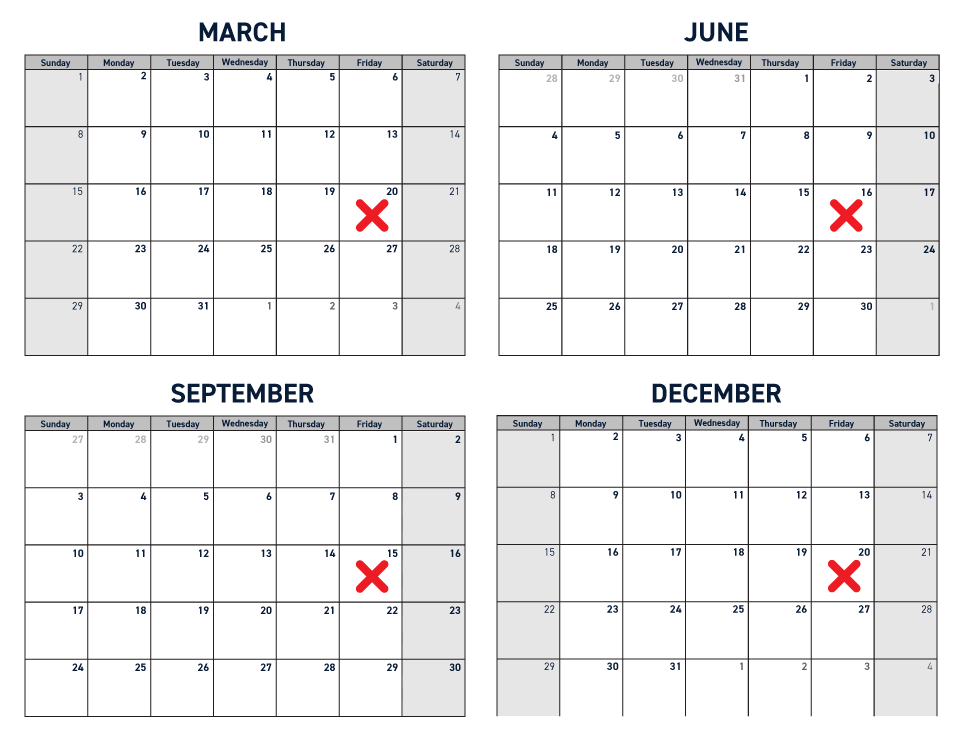

Quadruple witching days happen four times per year in March, June, September, and December. In 2022, the quadruple witching days are March 18, June 17, September 16, and December 16.

Components of Quadruple Witching

There are 4 derivatives that expire on quadruple witching days:

Single Stock Options

Single stock options give the owner the right, but not the obligation, to buy an underlying stock at a pre-determined price up until a preset expiration date. Options expire on the third Friday of every month. Traders must execute or sell their options on or before that date. Profitable (in-the-money) options are automatically executed at expiration.

Stock Index Options

Stock index options are similar to single stock options, except that they represent an entire stock index such as the S&P 500 instead of an individual stock.

Stock Futures

Stock futures are contracts that obligate the owner to buy or sell a specific stock at a predetermined price on a preset date in the future. When a futures contract expires, the holder is obligated to take ownership of the shares and the contract issuer is obligated to provide the shares. Stock futures contracts expire on the third Friday of every third month.

(Note: single stock futures were introduced in 2002. Prior to this, quadruple witching days were known as triple witching days, and the two terms are now used interchangeably.)

Stock Index Futures

Stock index futures are futures contracts that represent an entire stock index. Index futures are typically settled in cash rather than in shares.

Why is Quadruple Witching Significant?

Quadruple witching is significant because it results in higher-than-average trading volume across the stock market. On quadruple witching days, traders are typically selling or executing open options contracts, while profitable options contracts execute automatically. On the same day, all futures contracts must be settled and traders can open new futures contracts for the next three-month period.

This activity happens against the normal backdrop of trading activity, including trading on shares rather than derivatives. The result is that quadruple witching days are some of the biggest days of the year in terms of overall trading volume.

Impacts of Quadruple Witching

Quadruple witching’s biggest impact on the market is an increase in trading volume. Typically, increased trading volume is a good thing for traders since it translates to increased liquidity and is often accompanied by volatility.

However, increased trading volume on quadruple witching days is typically not accompanied by higher volatility. This is in part because institutional investors aren’t changing their large long-term positions on these days. The derivatives involved in quadruple witching are often used for hedging and represent small holdings relative to the stock positions that many institutional investors maintain. Traders may still be able to take advantage of increased volume for trading on quadruple witching days, but these days don’t necessarily present more trading setups than normal.

Still, quadruple witching days can result in highly volatile moves, especially if a firm has a large options or futures position that is being closed out. Large positions are often unwound around opening or closing on quadruple witching days, and traders should be on the lookout for block trades that cause significant price movements.

Conclusion

Quadruple witching occurs four times each year on days when single stock options, stock index options, single stock futures, and stock index futures expire simultaneously. The market usually experiences higher than average trading volume on quadruple witching days, but not necessarily higher than average volatility. Still, traders should be on the lookout for volatile movements on these days that could present opportunities for trading.